3 a new accounting standard that. Reporting entities that are exposed to risks from nonfinancial items mitigate them with derivatives such as futures forwards call and put options and swaps.

Fasb In Focus Accounting Standards Update No 2017 12 Derivatives Hedging Topic 815 Targeted Improvements To Accounting For Hedging Activities

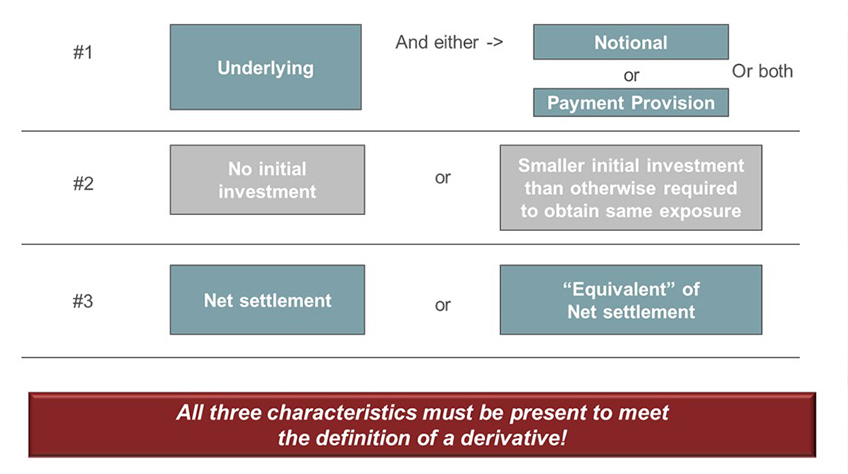

Contracts that meet the definition of a derivative and do not qualify for or are not otherwise designated under a scope exception are accounted for.

. The company will be taxed on any hedge ineffectiveness recognised in profit or loss. 1 the substantial cost of documentation and ongoing monitoring of designated hedges. Define Designated Pari Hedge Agreement.

An entity may view in combination and jointly designate as the hedging instrument any combination of the following including those circumstances in which the risk or risks. Cant decide on backpack lowepro protactic v peak design everyday in reply to chris234612323 jan 11 2018 thanks all. See also IFRS 9 Financial Instruments replacement of IAS 39 of the International Accounting Standards Board.

Many translated example sentences containing non-designated German-English dictionary and search engine for German translations. By doing so th e entity has eliminated both the foreign exchange risk and the fair value risk due to changes in interest rates. Edward Godsons Almshouses Cameron Street Heckington.

In reviewing the reports of a large sample of firms we find the following four explicit reasons why companies may decide not to designate derivatives as accounting hedges. Viele übersetzte Beispielsätze mit not designated as a hedge Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen. Firms with non-designated hedge positions have CDS spreads that are 100 basis points higher 77 higher relative to the mean than non-derivatives users.

A net investment hedge may be designated for the net investment in a foreign operation. However it is now exposed. Normally the hedging instrument is a purchased option based derivative contract which has a very limited risk but at the same time enables the entity to achieve significant gains.

Conjugation Documents Dictionary Collaborative Dictionary Grammar Expressio Reverso Corporate. Peak Design Everyday Backpack Vs Lowepro Protactic. Thus a hedging relationship is designated by an entity for a hedging instrument in its entirety.

Designated hedged items This narrative provides an overview of the eligible hedged items that are permitted in IFRS 9. When a non-option based derivative contract is used as a hedging instrument it is usually to peg the rate of a non-existing item at that point of time eg an. From time to time to hedge our price risk we may use and designate equity derivatives as hedging instruments including puts calls swaps and forwards.

Translations in context of hedging relationship is designated in English-German from Reverso Context. Translation Context Grammar Check Synonyms Conjugation. Non-designated heritage assets are buildings monuments sites places areas or landscapes identified by plan-making bodies as having a degree of heritage significance meriting consideration in planning decisions but which do not meet the criteria for designated heritage assets.

Us Derivatives hedging guide 72. The CCIRS is designated as hedging instrument in a fair value hedge first-level relationship. Harga peak design everyday backpack.

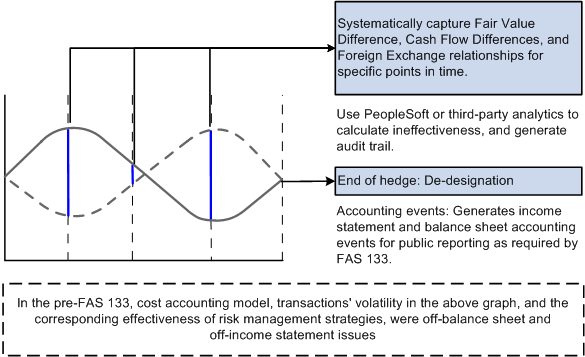

Cant decide on backpack lowepro protactic v peak design everyday in. Photoplus the best camera backpacks are among the best ways to keep your photo gear safe. A key purpose of hedge accounting is to reduce or preferably eliminate excess earnings variability by including in earnings a gain or.

Definition of hedged item Under IFRS 9 a hedged item can be a recognised asset or liability an unrecognised firm commitment a forecast transaction or a net investment in a foreign operation. Designated hedge agreement means any hedge agreement other than a commodity hedge device to which any credit party is a party and as to which a lender or any of its affiliates is a counterparty that pursuant to a written instrument signed by agent has been designated as a designated hedge agreement so that such credit partys counterpartys. Undesignated hedges If the cash flow hedge is undesignated the company will need to follow profit or loss which.

As of June 30 2012 the total notional amounts of designated and non-designated equity contracts purchased and sold were 14 billion and 982 million respectively. The hedged item can be. A fair value hedge may be designated for a firm commitment not recorded or foreign currency cash flows of a recognized asset or liability.

However a hedging instrument may not be designated for a part of its change in fair value that results from only a portion of the time period during which the hedging instrument remains outstanding. 2 the availability of natural hedges that can be highly effective. The CDS spread for a firm with a designated hedge position is 68 basis points lower 52 relative to the mean of 130 basis points than non-derivatives users.

Means each Designated Hedge Agreement in respect of which the notice delivered to the Administrative Agent by the Borrower and the applicable Lender Counterparty confirms that such Designated Hedge Agreement constitutes a Designated Pari Hedge Agreement for all purposes hereof so long as on the date of such designation or.

We Decided To Help People Stay Within The Designated Area By Making A Lovely Hedge Using Pretty Tea Olives Vinca Olive Trees Landscape Patio And Garden Plants

Trm Prospective Effectiveness Tests Sap Help Portal

How Is A Hedge Of Interest Rate Risk Impacted Kpmg Global

Derivatives And Hedge Accounting An Overview Of Asc 815 Gaap Dynamics

0 comments

Post a Comment